Dubai Real Estate Performance In An Unstable Global Market

“Market uncertainties are prevalent in all asset classes, from equities, to bonds, to alternative assets, and it is uncertain times that provide opportunity. What is for certain is this: Dubai has always benefited from global market uncertainty and was at the forefront of attracting FDI into the city in testing times for the region. In this report, we examine past trends of regional uncertainty and how this impacted Dubai” – Mr Abdullah Alajaji, CEO and Founder of Driven Properties

Against a backdrop of mounting uncertainty, markets have swung decisively into risk off mode. Escalating tensions in the Levant have rattled global assets: oil jumped 8.3 percent, its largest intraday move since 2022; gold attracted a full percent in safe haven flows; and equities fell, led by US and European indices. Stocks had only just recovered from April’s decline, triggered by fresh tariff friction between the US and China, so that fragile optimism has now given way to caution.

Against a backdrop of mounting uncertainty, markets have swung decisively into risk off mode. Escalating tensions in the Levant have rattled global assets: oil jumped 8.3 percent, its largest intraday move since 2022; gold attracted a full percent in safe haven flows; and equities fell, led by US and European indices. Stocks had only just recovered from April’s decline, triggered by fresh tariff friction between the US and China, so that fragile optimism has now given way to caution. In such condition, macroeconomic risk and property investment are closely related.

Periods like this reward disciplined investors. While the urge to react is strong, history shows that geopolitical shocks often highlight the value of steady conviction and thoughtful capital allocation.

DUBAI’S RESILIENCE DURING REGIONAL TURBULENCE

Dubai has long stood out as a refuge when its neighborhood turns volatile. Looking at Middle East real estate trends during the Arab Spring, the government upheld its treasured neutrality and rolled out measures that kept confidence high:

- AED 5.7 billion in federal aid for the northern emirates

- Salary increases for public-sector employees

- Extra funding for housing, education, and infrastructure

These steps drew capital from Egypt, Syria, Bahrain, Libya, and elsewhere in the Levant and North Africa. The pattern repeated during the conflict between Russia and Ukraine, when Dubai posted record transaction volumes and price gains, and again at the height of the global pandemic as investors sought stability in the UAE. Each time sentiment turned defensive, Dubai real estate gained fresh appeal,thanks to many factors including its resilient real estate markets.

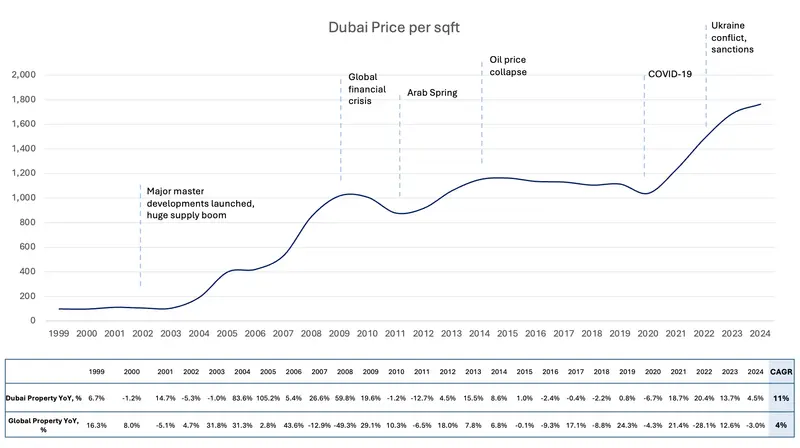

Let’s look at the performance of Dubai real estate during global crises.

WHY CAPITAL GRAVITATES TO DUBAI IN A CRISIS

Time and again, global shocks have driven capital, talent, and entire business operations to Dubai; constituting at times a real estate safe haven. The city is not immune to macroeconomic turbulence, but its exposure is lower than most peers, allowing it to absorb, rather than transmit, displaced demand and investment.

Currency stability

The UAE dirham is firmly pegged to the US dollar, insulating investors from the currency swings that often accompany periods of uncertainty.

Political neutrality

Balanced diplomacy with major powers, underscored by Dubai’s recent removal from the EU high-risk AML list, reinforces confidence and keeps foreign capital flowing.

High-quality assets

Prime property, supported by the absence of capital controls and income tax, offers both long- term value and clear exit options.

Short-term market volatility can still appear, but it often creates pricing inefficiencies. Agile, disciplined investors with liquidity and local insight, particularly in core and prime segments, are well positioned to turn those brief dislocations into opportunity. Amid geopolitical impact on real estate, Dubai investments during uncertainty still present a safer option for many individual and institutional investors.